The Central Bank of Sri Lanka in a Press release dated 2005 December 23rd justified the necessity to issue higher denomination currency notes, and stated that a Rs2000/- note has been printed. Now almost 4 month later we are still to see them in circulation.

Have you noticed that the currency notes even of high denomination are more dirty. Without the anticipated release of the Rs2000/- note the Central Bank has been forced to reuse dirty notes which would have been normally been removed from circulation. The April festive holidays generate to an unusually high demand for currency notes.

The highest denomination currency notes are generally for use in large cash transactions and should not seen in normal circulation. For example in USA the US$100, and US$50 don't circulate much. If you give a US$100 currency note in a grocery store the cashier has to take the note to the supervisor for approval of acceptance. Today in Lanka you could be using a Rs1000/- note in almost any environment, and probably not go to the grocery without one.

The Central Bank of Sri Lanka first issued the higher denomination currency notes of Rs500/- and Rs 1000/- in 1981 over 25 years ago. In 1981 the exchange rate to the US$ was Rs16.75 and the Rs1000/- and Rs500/- notes were worth about US$60 and US$30. Today these same denominations are worth under US$10 and US$5 In India the highest denomination note is Indian Rs1000, which is worth about US$25.

If you take the per capita GDP, USA has a per Capita GDP which is over 10 times that of Sri Lanka after it is normalized by the Purchasing Power Parity (PPP) of the currency in the local economy. The Highest denomination in USA is $100, and per capita GDP would seem to imply Sri Lanka should be able to manage with a US$10 or Rs1000/- note. So what is the real justification of the Rs2000 note in Lanka.

The largest useful denomination really depends on is the size of largest cash transactions. In USA the $20 is the highest in general circulation. Higher denomination currency notes are not needed because large transactions are most often done by personal check or credit card. In Lanka Cash is used a lot more since Credit Card penetration is not much, and personal checks are hardly accepted by any shop or restaurant. Cash is also probably used for many other reasons and as a consequence there is a urgent need for much higher denomination currency notes, at least the Rs2000/- note.

For reasons unknown to me Lankan government department prefers payment in cash. For example the immigration Department states that you can pay by Bank Draft or by cash. However, when I tried to pay a large sum by cashiers check since I didn't wish to carry that amount of cash in Rs1000/- notes they said my application would get delayed by 3 Weeks. The check needs to be sent to the head office for deposit, and they need to wait till they are informed back it has cleared. That day I clearly wished there was larger denomination notes so that I could easily count the cash I got from the bank counter.

Before the widespread development of the banking system and use of checks there was the need for currency notes of very large denomination to be able to inconspicuously transport large amount of cash to make payments. In fact the main reason for the invention of currency note few hundred years ago, was to avoided the need to transport gold and silver at the risk of being robbed. Till 1942 there was a Rs1000/- note which at that time was worth of order 80 gold sovereigns or a Million Rupees in Todays currency. There was even a Rs10,000/- note issued in 1947 for interbank transactions.

The efficient banking system has removed the need for very high denomination notes. The Rs100/- note was the largest denomination for a long time since the Central Bank of Ceylon was established in 1950, and was worth about 2.5 gold sovereigns early 1950's. With Electronic transfers for many transactions we are heading toward a coin and currency less society. However that is in the distant third world future.

The risk of forgery is the major drawback high denomination currency notes. With modern computer technology forgeries of the Rs1000 and Rs500 notes have been made which will go unnoticed by the public in a bundle of notes, although easily identified by closer inspection of the security features. It is the reason for the elaborate designs on currency notes.

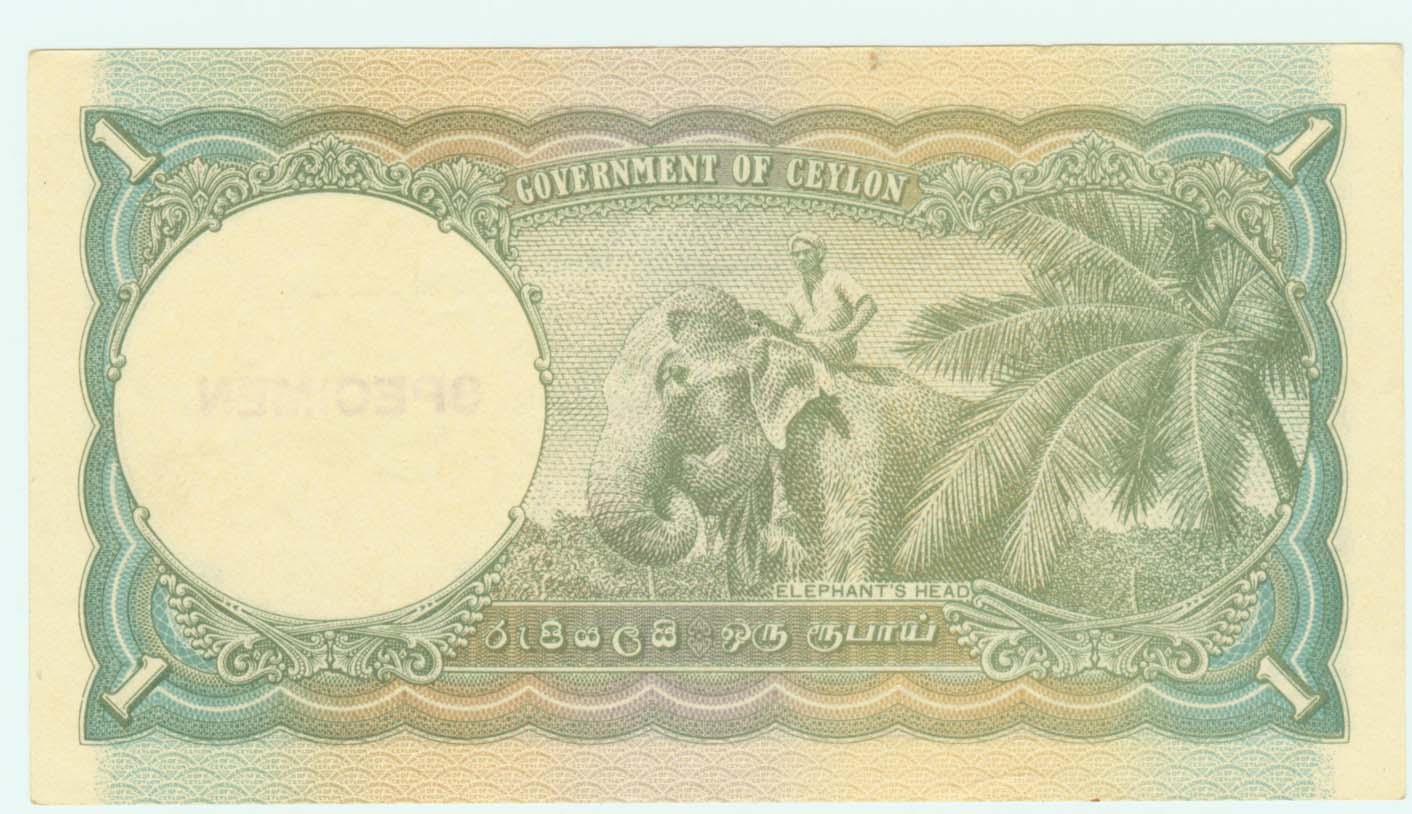

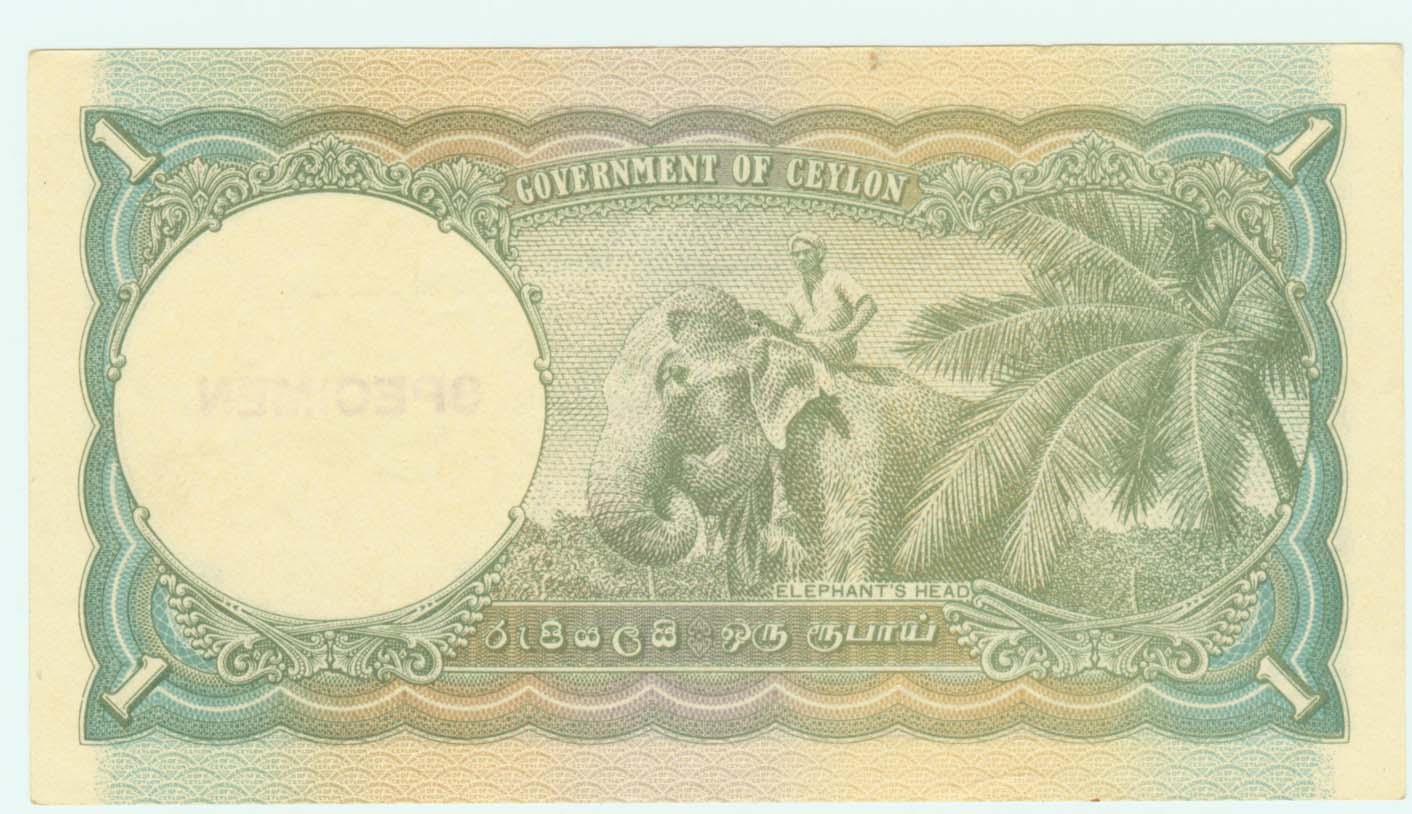

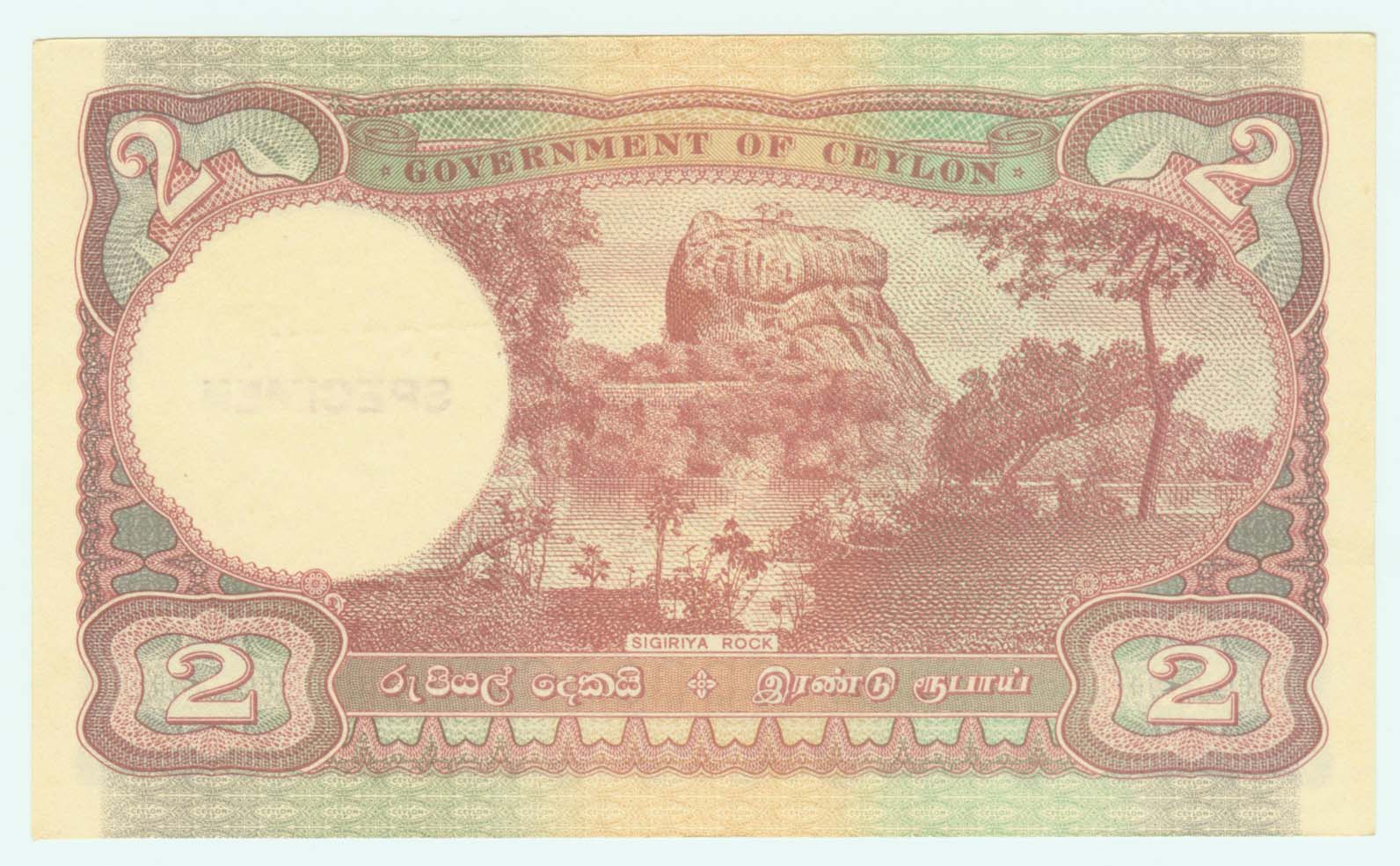

Currency notes were issued with pictorial designs for the first time on 1941 February 1st. In the early 1940's a sovereign was worth about Rs13 while it is worth over Rs13,000 today. The one rupee currency note of that time is worth Rs1000/- in today's currency. It had an image of Elephant's Head with a mahout on the reverse matching that found on the front of the Rs1000/ note. The two rupee currency note had an image of the Sigiriya Rock. It is strongly rumored that the new Rs2000/- note which has been printed has Sigiriya on it to match the old series.

In 1852 the British Gold Sovereign was made legal tender in Ceylon

and was the coin of largest denomination that was legal tender in the

island. When the Rs1000/= note was reintroduced in 1981. that was then

worth about a half a sovereign. So the main justification for the

Rs2000/- note is the purchasing power of the currency as reflected by

the Price of Gold. The largest denomination note needs to be about

the price of half a gold sovereign now worth over Rs7000/-.

Interestingly even a thousand years ago the largest denomination in

Lanka was a Kahavanu made with about half a sovereign of gold.

In 1852 the British Gold Sovereign was made legal tender in Ceylon

and was the coin of largest denomination that was legal tender in the

island. When the Rs1000/= note was reintroduced in 1981. that was then

worth about a half a sovereign. So the main justification for the

Rs2000/- note is the purchasing power of the currency as reflected by

the Price of Gold. The largest denomination note needs to be about

the price of half a gold sovereign now worth over Rs7000/-.

Interestingly even a thousand years ago the largest denomination in

Lanka was a Kahavanu made with about half a sovereign of gold.

Author maintains an educational website on two thousand years of Lankan coins at http://coins.lakdiva.org.lk/, and is Vice President of the Sri Lanka Numismatic Society.

See Also